We’re thrilled to announce that Boyer & Associates is a 2023 Microsoft US Partner of the Year! We won the award for Social Impact, Inclusion Changemaker.“We would like to extend our congratulations to the winners and finalists of the 2023 Microsoft Partner of the Year Awards,” said Nina Harding, Corporate Vice President of Microsoft US Global Partner Solutions. “(They) have demonstrated the best of what’s possible with the Microsoft Cloud by providing innovative new solutions and services that positively impact customers and enable digital transformation.”Microsoft announced the 2023 award winners on June 28 in the US Partner Community Blog. There were nearly 800 submissions for this particular award.“We are humbled to be noticed … [Read more...] about Boyer named 2023 Microsoft US Partner of the Year

Improve team synergy with Dynamics 365 Finance and Sales integration

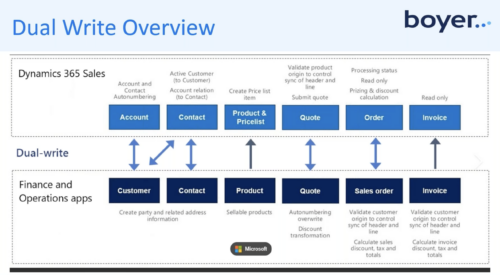

Our clients are always looking for ways to streamline operations and enhance customer engagement. It’s a task that is relatively low-effort and extremely high reward. One way we help clients do this is through the integration of Dynamics 365 Finance and Sales. This integration stands out as a beacon of efficiency in this technology-driven age, promising an interconnected experience between the back-office and front-facing teams.Convergence of two Microsoft powerhousesOur recent webinar highlighted the formidable union of Microsoft Dynamics 365 Finance & Supply Chain Management (formerly Finance and Operations) and Dynamics 365 Sales (formerly Dynamics CRM). The session unveiled how Dual-write, Microsoft's integration … [Read more...] about Improve team synergy with Dynamics 365 Finance and Sales integration

Boyer’s Business Central consulting team is growing

Will Haber joins as senior Business Central consultantBoyer & Associates is pleased to announce that our Business Central consulting team is growing. Will Haber recently joined the Minneapolis-based company as a senior consultant for Microsoft Dynamics 365 Business Central.As a child, Haber had a propensity for math and science, and he loved space. NASA posters covered his bedroom walls, and he had a celebrity crush on astrophysicist Neil deGrasse Tyson.“I saw the beauty in numbers and science … and how it can be used in different innovations in our world,” Haber said.He majored in Industrial and Systems Engineering at the University of Florida. Two internships gave him early work experience in warehousing and inventory. Haber got a job … [Read more...] about Boyer’s Business Central consulting team is growing

MSP Experts: How to Spot the Good From the Bad

Have you ever wondered how to distinguish between good and bad managed service providers (MSPs)?With so many options available in the market, it can be a daunting task to find the right one for your business needs. However, fear not, as certain indicators can help you make an informed decision.From evaluating credentials to assessing ongoing support quality, this discussion will provide you with valuable insights on how to spot the good from the bad MSPs.As a leading Microsoft partner, Boyer & Associates has comprehensive expertise regarding managed services and your business. Learn more about how we can help. Key TakeawaysUnderstanding MSP ExpertiseTo understand MSP expertise, you need to look beyond the surface and evaluate their … [Read more...] about MSP Experts: How to Spot the Good From the Bad

Transformative technologies: AI unleashed in Microsoft Dynamics 365 Supply Chain

Artificial Intelligence is revolutionizing the world of supply chain management. It’s helping businesses streamline their operations, reduce costs, and improve customer satisfaction. Microsoft has been at the forefront of incorporating AI in its supply chain management solutions.What is AI for supply chain?Artificial Intelligence, or AI, refers to the simulation of human intelligence by machines. This includes learning, reasoning, and self-correction capabilities. In simple terms, AI allows machines to perform tasks that typically require human intelligence.In the context of supply chain management, AI can help automate repetitive and time-consuming tasks, analyze data to spot trends, and make predictions for future outcomes. This helps … [Read more...] about Transformative technologies: AI unleashed in Microsoft Dynamics 365 Supply Chain

Finding the Best Cloud Managed Service Providers

Are you tired of struggling to manage your company’s cloud services? It’s time to find the best cloud-managed service providers who can set you free from the stress of maintaining and optimizing your cloud infrastructure.With their expertise and support, you can focus on what really matters – growing your business. But how do you find the right provider that aligns with your unique needs and desires?This guide will walk you through the process, from understanding the benefits of cloud-managed services to evaluating your business requirements and considering key factors. We’ll also introduce you to Microsoft’s top cloud environments coupled with Microsoft support.Get ready to make an informed decision that empowers your business and unlocks … [Read more...] about Finding the Best Cloud Managed Service Providers

Boyer hires new Microsoft CRM and Power Platform consultant

Minneapolis-based Microsoft consulting firm Boyer & Associates continues to grow. We are thrilled to welcome Jamie Gipp as a senior CRM and Power Platform consultant.Gipp originally wanted to be an athletic trainer and earned her bachelor’s degree in health management. Her plans to go to grad school took a detour when a family member became ill. Instead, she took a job in retail management and then in corporate relocation.“I still love the healthcare world. I love the dynamic of it. I am passionate about sports and health,” she said.Gipp spent the next 12 years in the banking industry, first in corporate relocation and then in corporate real estate financing. Working with high net-worth clients helped her fine-tune her people skills, … [Read more...] about Boyer hires new Microsoft CRM and Power Platform consultant

What the Top Managed Services Providers Have in Common

Are you ready to soar to new heights in the world of managed services providers? Just like you might have guessed, the top MSPs have a few key traits in common.Industry leaders know that customer service is a priority, always putting the needs of clients first. They embrace the latest technologies, utilizing them to navigate the ever-changing landscape of Microsoft solutions.And, of course, they prioritize security, maximizing Microsoft business apps’ features to keep clients’ data safe from any potential threats.So, if you’re looking to join the ranks of the best, keep these common traits in mind as you spread your wings and take flight.Key TakeawaysEmphasis on Customer ServiceWhen it comes to customer service, top Microsoft managed … [Read more...] about What the Top Managed Services Providers Have in Common

Microsoft ERP support consultant joins Boyer team

A love for Microsoft technology and a drive to learn more has come full circle for Boyer’s newest Microsoft ERP support consultant. Brad Burks went from reading Boyer blogs to joining the consulting team.A typical child in the 1990s, Burks grew up spending hours on his family computer and playing video games. His love for technology solidified early, he went to college to get a degree in Management Information Systems.There was no question in his mind that he wanted to work with technology — specifically with Microsoft software. He’s always liked the Microsoft ecosystem.Burks started out at a small Microsoft partner in south Florida that consulted on Dynamics GP. When the company decided to branch out into Microsoft’s cloud ERP, Burks … [Read more...] about Microsoft ERP support consultant joins Boyer team

Maximizing ROI with Microsoft Dynamics 365 Finance & Supply Chain Management

Are you looking for a competitive edge while still maximizing your ROI (Return on Investment)? In today's rapidly evolving business landscape, organizations need an effective solution that can do this. From ensuring timely delivery of goods to minimizing waste and maximizing efficiency, a well-run supply chain can make all the difference for your business. But to truly succeed, you need a management solution that can help you keep track of everything from orders to inventory to logistics. Microsoft Dynamics 365 Finance & Supply Chain Management, with its powerful features and intuitive interface, can help you streamline your supply chain, reduce costs, and boost your bottom line. When legacy, on-premise ERP solutions just aren’t keeping … [Read more...] about Maximizing ROI with Microsoft Dynamics 365 Finance & Supply Chain Management

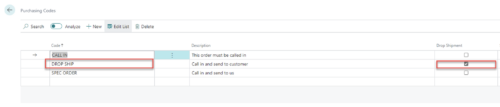

How to set up and use drop shipping in Business Central

Drop shipping in Business Central has become a popular order fulfillment method in the world of e-commerce and retail. It offers companies and businesses a cost-effective way to expand their product offerings without the need for extensive warehousing and inventory management. Microsoft Dynamics 365 Business Central is a powerful ERP system that can streamline and automate the drop shipping process. In this blog, we'll walk you through the drop shipping process within Business Central, from setup to execution.Table of Contents1. Understanding Drop ShippingDrop shipping is a procurement fulfillment method where a business doesn't keep the products it sells in stock. Instead, when a business sells a product, it purchases the item from a … [Read more...] about How to set up and use drop shipping in Business Central