In a previous post, we looked at the currency revaluation process in Microsoft Dynamics GP, which generates unrealized currency gains or losses. In this post we will look at a process that creates realized currency gains or losses in Dynamics GP.

Realized currency gains or losses are calculated when an open foreign currency transaction is settled in the Receivables Management or Payables Management modules, and the exchange rate on the settlement date is different from the exchange rate from the date of the original transaction. The direction of the change in the exchange rate determines whether a gain or loss is calculated.

Continuing the example from the previous post, we have a GP company with functional currency of U.S. Dollars (USD). In that company we posted two sales invoices in Euros on 3/10 and 3/20 that were translated to USD using rates from the exchange table.

| Invoice Date | Orig Amt (EURO) | Functional Amt (USD) | FX Rate |

| 3/10/2027 | €10,000 | $11,000 | 1.1 (from GP exchange table) |

| 3/20/2027 | €20,000 | $24,000 | 1.2 (from GP exchange table) |

| Total | €30,000 | $35,000 | 1.1666667 (blended) |

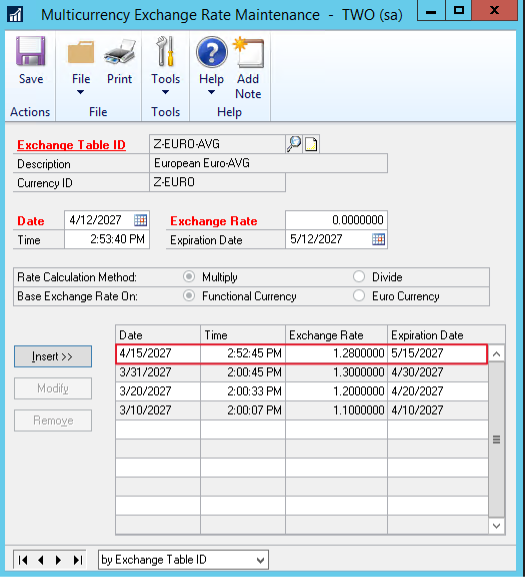

On 4/15 we received a payment of €30,000 from the customer. Before processing the payment, we must enter a valid exchange rate for the payment date of 4/15. In this example the rate is 1.28 as shown below.

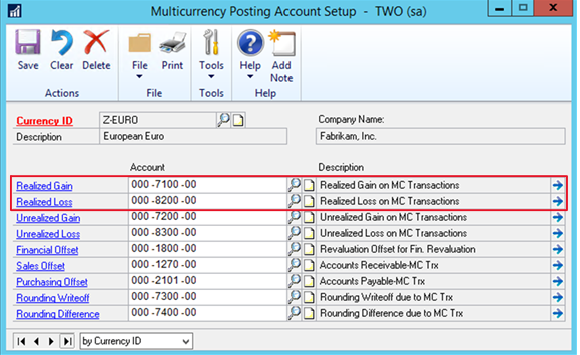

We must also configure the currency posting accounts under Financial > Setup > Currency Accounts. For this example, the Realized Gain/Loss accounts will be used.

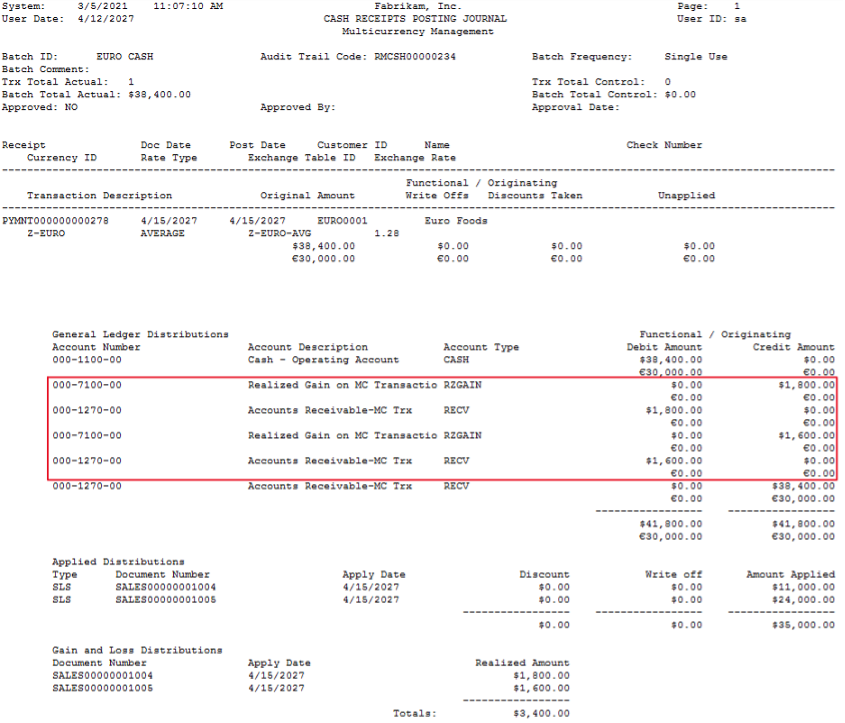

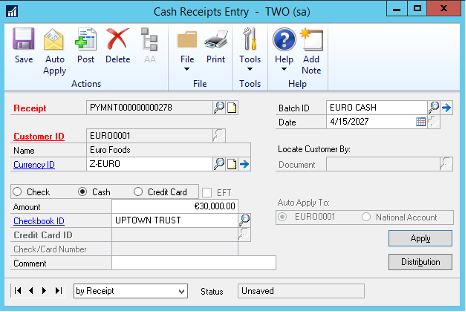

The payment is entered in Cash Receipts Entry with a date of 4/15.

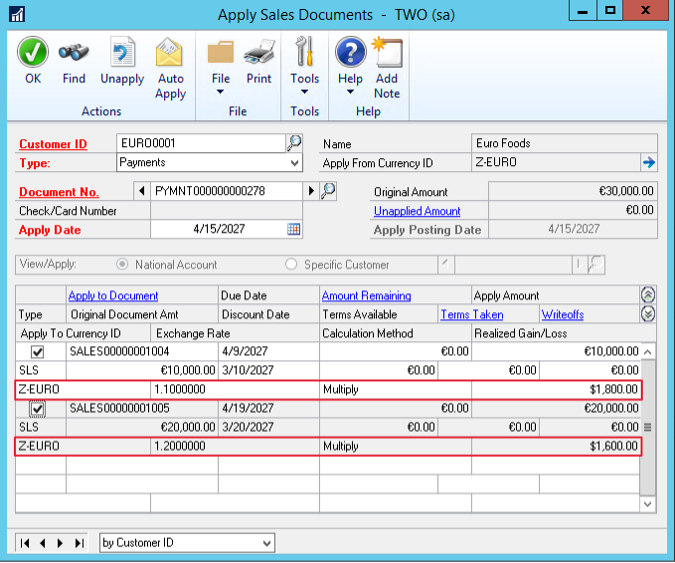

Click the “Apply” button to apply the payment to the two open invoices. Expand the invoice lines to see the originating exchange rates and the calculated realized gain or loss for each invoice.

The realized gain or loss calculation is simply the difference between the translated invoice amount and the translated applied payment amount. In this example, realized gains were calculated because the payment exchange rate was higher than the invoice exchange rate.

| Invoice Date | Original Amount (EURO) | Invoice Rate | Translated Invoice Amount (USD) | Payment Date | Payment Rate | Translated Applied Payment Amount (USD) | Realized Gain (USD) |

| 3/10/2027 | €10,000 | 1.1 | $11,000 | 4/15/2027 | 1.28 | $12,800 | $1,800 |

| 3/20/2027 | €20,000 | 1.2 | $24,000 | 4/15/2027 | 1.28 | $25,600 | $1,600 |

When the cash receipt is posted, the realized gains or losses are distributed to the General Ledger. In this example the realized gains are recorded to the Realized Gain account 000-7100-000 from the Multicurrency Posting Account Setup. The offsets are recorded to the original account 000-1270-00.