Budgeting is more than just a financial exercise — It’s a strategic tool that empowers organizations to plan, monitor, and adapt. In Microsoft Dynamics 365 Business Central, the budgeting functionality within financial reporting enables teams to take ownership of their numbers, track performance, and make informed decisions.

Why budget?

Creating budgets in Business Central allows those responsible for financial outcomes to contribute to the numbers they’ll be held accountable for. Comparing actuals to budgeted figures helps organizations identify issues early and take corrective action before it’s too late. It also fosters a deeper understanding of what drives the business, helping to improve profitability or expand services for nonprofits. Budgeting can help eliminate unnecessary expenses and answer the fundamental question: How well is your organization really doing?

New to budgeting?

If you’re new to budgeting within your ERP system, start simple. Use the average of the last 12 months by G/L account or import last year’s results as your baseline budget. As you begin comparing actuals to budget, consider adding dimensions like departments or divisions. Over time, you’ll notice patterns such as expenses tied to sales, specific employees or seasonality. This knowledge will help you build a more accurate and detailed goal-driven budget for each month.

Use your organization chart as an accountability chart to assign budget ownership. And remember: You can’t improve what you don’t measure!

Setting up budgets in Business Central

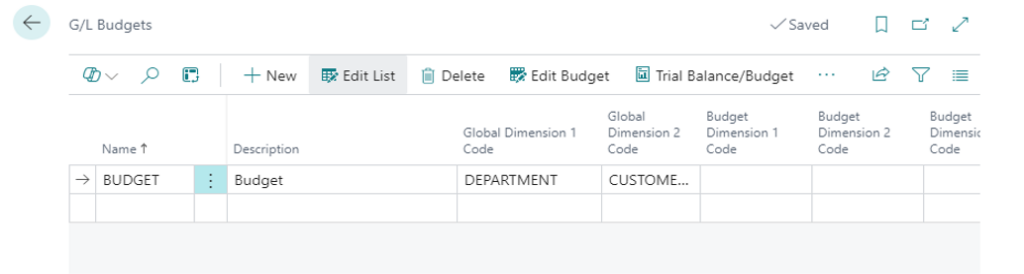

- Navigate to Finance, G/L Budgets.

- Click New to create a budget. Avoid naming budgets by year or month —Business Central already understands time periods, and adding a year-specific budget name means you will have to change every report for the new budget name each year. Instead, use simple reusable names like “Budget,” “Forecast Q3” or “Budget – Stretch.”

- Choose the dimensions you want to track for the budget.

- Don’t forget to save your new budget.

Export a budget

- To export your budget, click on the row and click Edit Budget.

- Click Export to Excel.

- Select your start date, number of periods (typically 12), and dimensions needed.

- Click OK.

Tips for populating the file

- Don’t move columns or insert columns from A to the end of your periods.

- It’s ok to delete rows, except when there is a number in the periods. Deleting will not delete the data in BC, so instead replace the data with a 0.

- Populate rows with your budget by period, and remember that sales are a negative.

- Insert rows for the different dimensions. The account description is not needed to import.

- Save your file.

Import a budget into Business Central

- To import your budget, click on the row and click Edit Budget.

- Click Import to Excel.

- Select the Excel file where you entered your budget.

- Save and Import the file back into Business Central.

- Run a financial report to validate your data.

Pro tips

- Start early. Ideally, set up budgets in Business Central in Q4 for the following year.

- Maintain a single master budget file so you can easily make updates and track those changes.

- Communicate clearly to all involved. When people know a budget is being tracked, spending behavior often improves.

- Be realistic and back up your budget numbers with rationale. Detailing how the numbers were budgeted can assist in explaining why actuals may have deviated from the budget later.

- Stay flexible. You can’t see the future. Consider having multiple budgets to account for unexpected changes like cost spikes or surprise revenue wins.

Related Content: Unlocking insights with Business Central’s analysis view