Balancing financial dimensions often feels like threading a needle — It requires precision to ensure your organization’s accounting entries are accurate and compliant. Thanks to modern tools like Microsoft Dynamics 365 Finance and Supply Chain Management (FSCM), this task just became more efficient than ever.

Let’s discover more on how balancing entries in general work and how your organization can use financial dimensions in FSCM to save time, reduce errors, and improve financial accuracy.

Plus, check out our short video demo to see these tools in action.

Balancing financial dimensions ensures your balance sheet is accurate not just at a total level, but also for specific financial dimensions. For example, a nonprofit might want to track and balance finances at the fund level, while a corporate entity might aim to balance entries by department or cost center.

Two key features in Microsoft Dynamics 365 FSCM make this possible:

- Ledger Setup Balancing Dimension

- Financial Dimensions Balancing Requirement

Each option automates the balancing process by either generating automatic entries to correct imbalances or flagging any inconsistencies for manual adjustments. The choice between the two depends on your specific business needs.

Why is balancing financial dimensions in FSCM important?

Ensuring financial dimensions are balanced is more than just an accounting best practice; it’s often a regulatory requirement in industries such as public sector and nonprofit. Some key benefits include:

- Reduced Errors: Automation minimizes human oversight.

- Time Savings: Manual adjustments become a thing of the past with system-generated entries.

- Enhanced Compliance: Helps meet audit and reporting standards at both regulatory and operational levels.

- Improved Resource Allocation: Provides a clearer view of where funds and resources are flowing within specific dimensions.

Now, let’s dig into how to set up and use these tools effectively.

Two Methods to Set Up Balancing Dimensions

Method 1: Ledger balancing using financial dimensions

This method is ideal for streamlining inter-unit accounting through automation. Here’s how to set it up in Dynamics 365 FSCM:

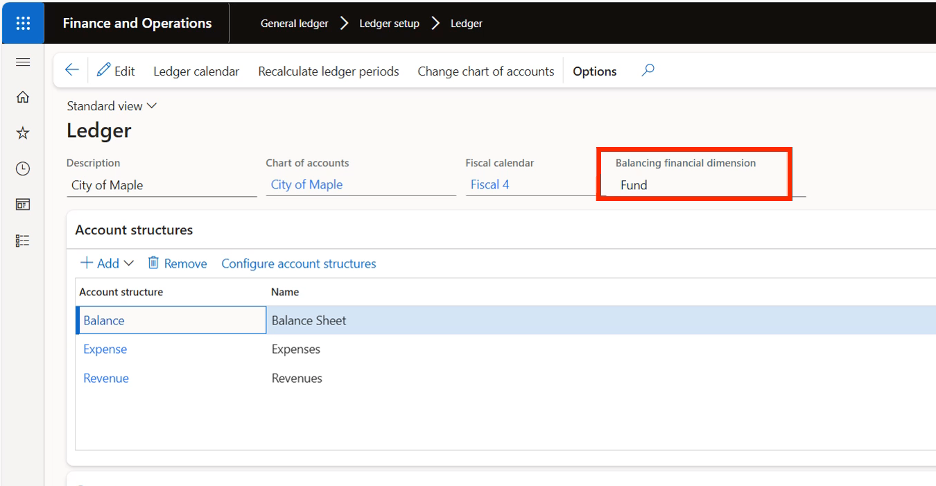

- Identify Balancing Dimension: Choose a single financial dimension to balance, whether it’s funds, departments, or cost centers.

- Update Account Structures: Ensure that the chosen dimension is included in all account structures and restrict blanks to ensure every entry is tied to a specific dimension.

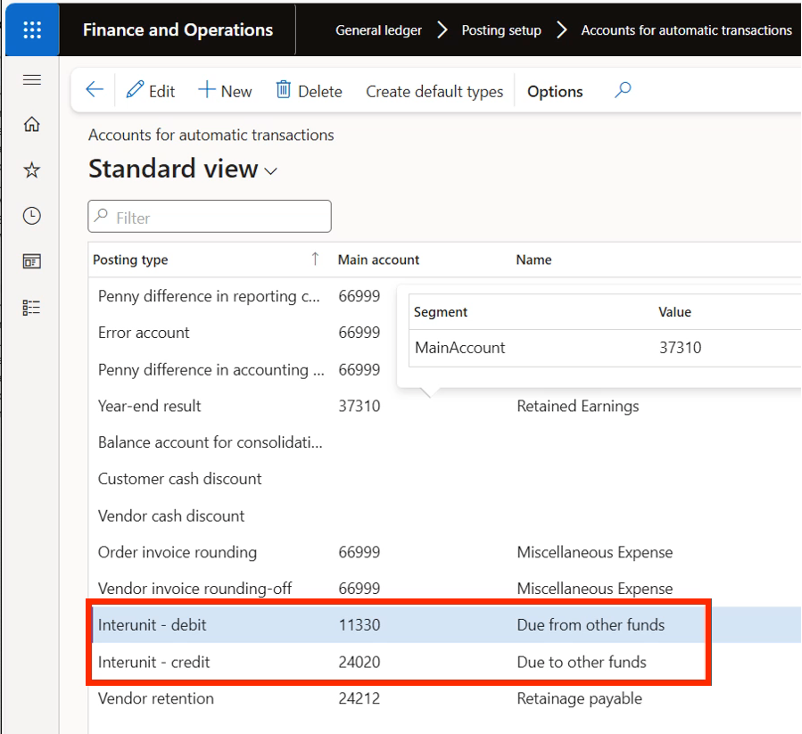

- Define Automatic Transactions: Assign interunit debit and credit accounts for the system to use when balancing entries.

- Enable Ledger Balancing: Within the ledger setup (general ledger > ledger setup > ledger), select your chosen dimension as the balancing dimension.

Once configured, any out-of-balance transactions are automatically corrected by generating additional accounting entries. For example, a $1,000 imbalance between Fund A and Fund B is automatically adjusted with due-to and due-from entries.

Pro Tip: Use this method if your organization prioritizes automation and processes high transaction volumes, as it saves time while ensuring accuracy.

Method 2: Requiring balance at the financial dimension level

This method is primarily used by public sector organizations and involves more manual control. Here’s the process:

- Identify Balancing Dimensions: You can choose more than one financial dimension to balance.

- Create Posting Definitions: Define rules for every journal or source document type. Posting definitions will ensure balanced entries by adding required debit and credit postings.

- Activate Balance Requirement: Enable balancing for selected dimensions by marking them as required in the Financial Dimensions page.

Unlike ledger balancing, this method flags discrepancies for manual adjustments if posting definitions cannot balance the transaction.

Pro Tip: Choose this method if your organization requires rigorous manual controls or if automation isn’t always feasible for your transaction types.

More on ledger balancing in FSCM

To illustrate how ledger balancing works, let’s break it down – or you can watch the video to see how it all works.

- A nonprofit organization tracks fund-specific transactions.

- The ledger is configured to use “Fund” as the balancing dimension.

- A journal entry credits $1,000 to the UE Fund and debits $1,000 from the RE Fund, resulting in an imbalance at the fund level.

Dynamics 365 automatically creates balancing due-to and due-from entries, ensuring the transaction is balanced at the fund dimension without manual intervention.

This seamless process reduces errors, speeds up journal posting, and ensures complete accuracy.

Which method should you choose?

The method you select depends on your organization’s operational structure and regulatory requirements.

- Choose ledger balancing if you require automation to handle high transaction volumes and reduce manual workload.

- Choose Financial Dimensions Balancing Requirement if you need stricter, transaction-specific controls or if posting definitions are a compliance requirement.

When in doubt, experts like Boyer Associates can help you identify the best setup of financial dimensions in FSCM for your enterprise.

Enhance your financial efficiency!

Balancing financial dimensions doesn’t have to feel overwhelming. With tools like Microsoft Dynamics 365 FSCM, you can streamline your accounting processes and focus more on growing your organization.

Need help tailoring the perfect setup for your organization? Contact Boyer today for expert guidance and support. Together, we’ll create a seamless financial workflow that saves time, reduces costs, and improves data accuracy.